Bingo: Can I withdraw bonus funds?

to withdraw you must satisfy the bonus conditions.

Full Answer. Account holders must take required minimum distributions individually from each 401 (k) plan. Although account holders must calculate required minimum distributions of each traditional IRA separately, they can withdraw funds from any of the accounts to satisfy the requirement. IRA account holders should take the distribution from

Full Answer. Account holders must take required minimum distributions individually from each 401 (k) plan. Although account holders must calculate required minimum distributions of each traditional IRA separately, they can withdraw funds from any of the accounts to satisfy the requirement. IRA account holders should take the distribution from

$50 NO Deposit Bonus - SuperForex | All Forex Bonus

You will fully or partly satisfy your RMD with any withdrawals you choose to make. If you don’t make any withdrawals or if your withdrawals fall short of the required amount, we will automatically send you the amount thats still required. This section explains the different rules that apply in your first distribution calendar year and in your

You will fully or partly satisfy your RMD with any withdrawals you choose to make. If you don’t make any withdrawals or if your withdrawals fall short of the required amount, we will automatically send you the amount thats still required. This section explains the different rules that apply in your first distribution calendar year and in your

Terms and Conditions - Coral

In some cases the employer may wish to retain maximum discretion in respect of the entitlement to a bonus, the amount of any bonus, the date of payment, and the conditions governing entitlement. If this is the case, it should have a clause

In some cases the employer may wish to retain maximum discretion in respect of the entitlement to a bonus, the amount of any bonus, the date of payment, and the conditions governing entitlement. If this is the case, it should have a clause

Bonus Policy | Promotions | 888casino™

to withdraw you must satisfy the bonus conditions.

The Users further agree and acknowledge that the Company shall hold the Bonus Amount (if any) in the Bonus Component of the Winnings and Bonus Account in trust, for and on behalf of the respective users until such time as the User may decide to utilize it to play a cash Game or withdraw the same, in accordance with the terms and conditions of

The Users further agree and acknowledge that the Company shall hold the Bonus Amount (if any) in the Bonus Component of the Winnings and Bonus Account in trust, for and on behalf of the respective users until such time as the User may decide to utilize it to play a cash Game or withdraw the same, in accordance with the terms and conditions of

Terms & Conditions | Play Indian Rummy Game Online For Free

to withdraw you must satisfy the bonus conditions.

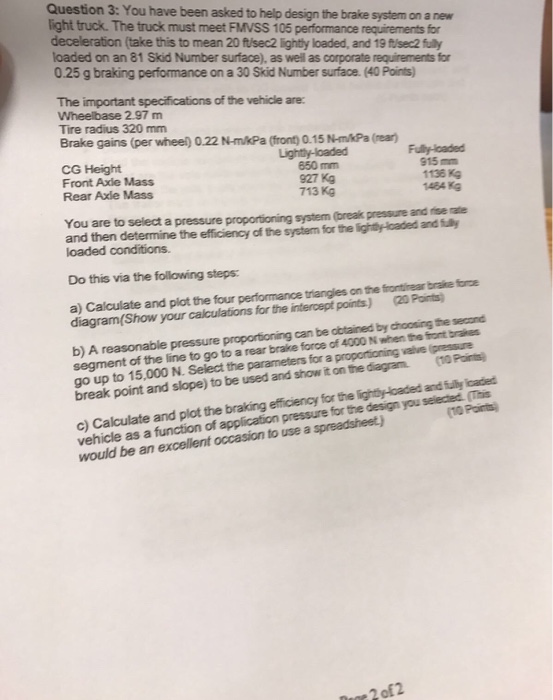

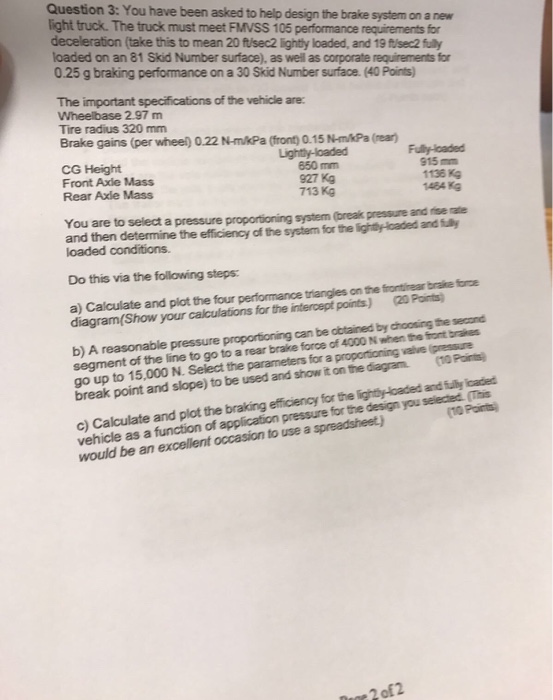

In order to make a withdrawal, you must satisfy the wagering conditions of 2x the amount of your qualifying deposit and bonus. Only single bets with min. odds of 1.40, and combo bets with total min. odds of 1.96 and min. odds of 1.40 per selection count towards the wagering conditions.

In order to make a withdrawal, you must satisfy the wagering conditions of 2x the amount of your qualifying deposit and bonus. Only single bets with min. odds of 1.40, and combo bets with total min. odds of 1.96 and min. odds of 1.40 per selection count towards the wagering conditions.

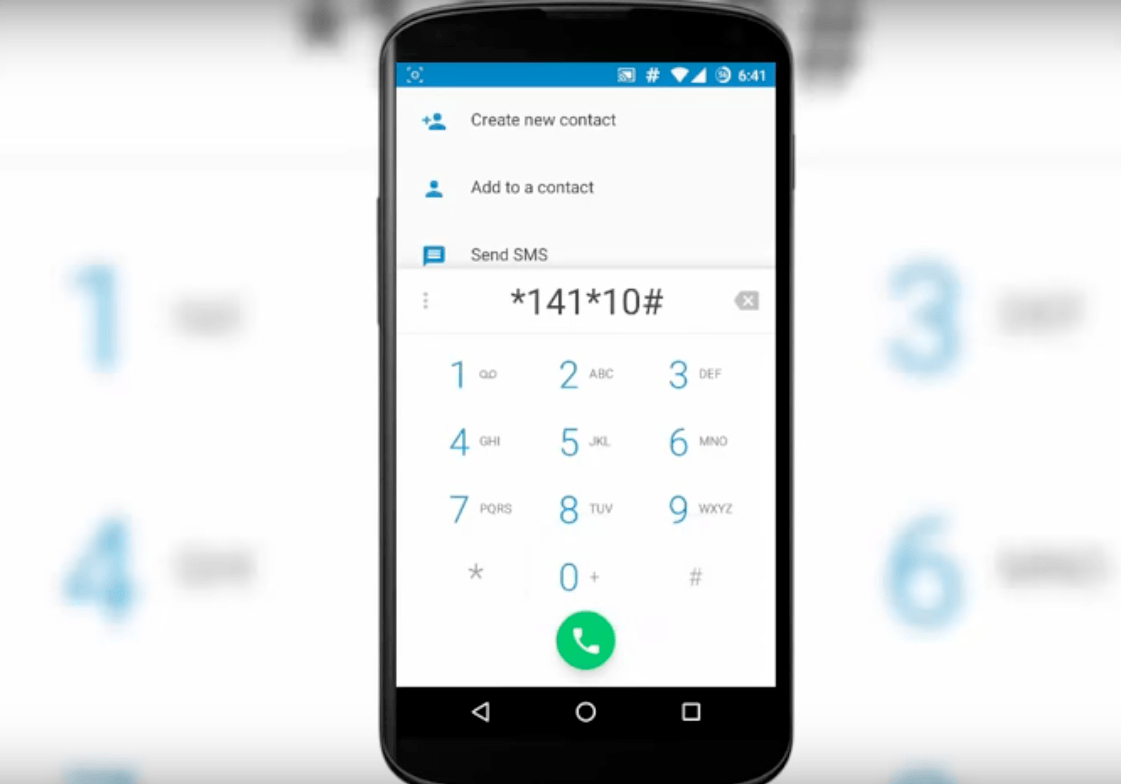

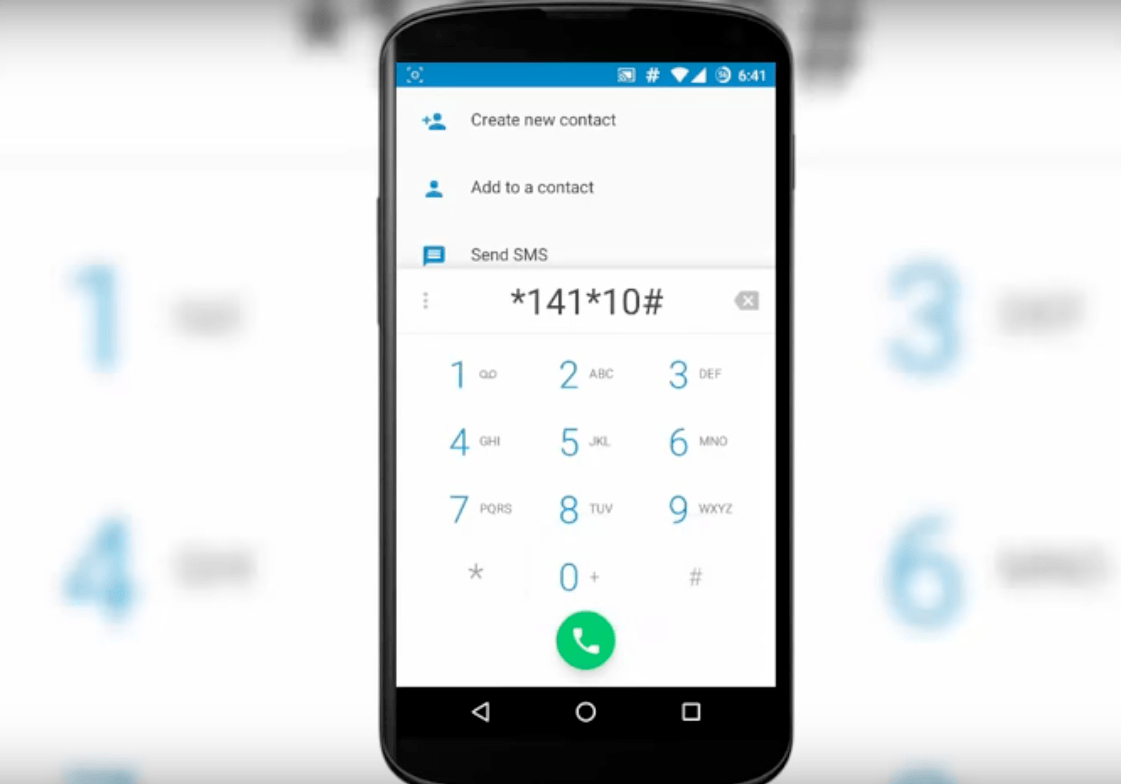

ChezaCash: How to Register, Deposit, and Withdraw - Sports

to withdraw you must satisfy the bonus conditions.

Full Answer. Account holders must take required minimum distributions individually from each 401 (k) plan. Although account holders must calculate required minimum distributions of each traditional IRA separately, they can withdraw funds from any of the accounts to satisfy the requirement. IRA account holders should take the distribution from

Full Answer. Account holders must take required minimum distributions individually from each 401 (k) plan. Although account holders must calculate required minimum distributions of each traditional IRA separately, they can withdraw funds from any of the accounts to satisfy the requirement. IRA account holders should take the distribution from

Does a 401(k) Required Minimum Distribution Count Towards

The bonus is not going to be returned to the account but deducted from winnings. From the overall sum of cash-out, all bonus money will be removed at the point of withdrawal. In the event that a Player wishes to claim a bonus, it must be redeemed by the Player before placing any wagers with their deposit.

The bonus is not going to be returned to the account but deducted from winnings. From the overall sum of cash-out, all bonus money will be removed at the point of withdrawal. In the event that a Player wishes to claim a bonus, it must be redeemed by the Player before placing any wagers with their deposit.

Withdrawing From Your Retirement Accounts | TIAA

3. Conditions of Eligibility 3.1. Subject to, and without prejudice to, all other Business Terms and Policies, the Offer is available to XM’ Clients who have satisfied the Eligibility Criteria for the Offer (“Eligible Client”) as set out in the Sections following hereinafter. 3.2.

3. Conditions of Eligibility 3.1. Subject to, and without prejudice to, all other Business Terms and Policies, the Offer is available to XM’ Clients who have satisfied the Eligibility Criteria for the Offer (“Eligible Client”) as set out in the Sections following hereinafter. 3.2.

Empl Bonuses and employment law - Reed Smith

to withdraw you must satisfy the bonus conditions.

Memorial Day Bonus! Memorial Day weekend is here and we want to give you up to $40 in bonus play each day! From May 26 – 29, you can receive a daily 20% bonus on deposits up to $200 when you use bonus code DAILY20.

Memorial Day Bonus! Memorial Day weekend is here and we want to give you up to $40 in bonus play each day! From May 26 – 29, you can receive a daily 20% bonus on deposits up to $200 when you use bonus code DAILY20.

XM Bonus, Terms and Conditions

You will be able to trade the bonus only after you have traded with your deposit. You can withdraw the profit you make from the bonus ($10,000 in volume for every one dollar of bonus), only if you have reached the trading volume required for the entire amount of the bonus granted to you. All this needs to happen in 30 days.

You will be able to trade the bonus only after you have traded with your deposit. You can withdraw the profit you make from the bonus ($10,000 in volume for every one dollar of bonus), only if you have reached the trading volume required for the entire amount of the bonus granted to you. All this needs to happen in 30 days.

Vegasrush Casino

So if you store phone numbers for both marketing and identity verification purposes, you must obtain consent for each purpose. Consent must be informed Informed consent means the data subject knows your identity, what data processing activities you intend to conduct, the purpose of the data processing, and that they can withdraw their consent

So if you store phone numbers for both marketing and identity verification purposes, you must obtain consent for each purpose. Consent must be informed Informed consent means the data subject knows your identity, what data processing activities you intend to conduct, the purpose of the data processing, and that they can withdraw their consent

Important Tax Information About Your TSP Withdrawal and

You will have to withdraw a minimum amount each year, depending on your age, and if you are using a transition to retirement pension you will be limited to withdrawing a maximum of 10% each year. In order to access your super due to severe financial hardship and compassionate grounds, you are required to meet conditions set by the Federal Government.

You will have to withdraw a minimum amount each year, depending on your age, and if you are using a transition to retirement pension you will be limited to withdrawing a maximum of 10% each year. In order to access your super due to severe financial hardship and compassionate grounds, you are required to meet conditions set by the Federal Government.

Does a 401(k) Required Minimum Distribution Count Towards

This means that you will need to wager your bonus a specified number of times before you can withdraw any of your winnings. Bonus funds are non-withdrawable. Until you have completed the specified wagering requirement, any winnings you make will be held as ‘pending winnings’. If your Bonus reaches its expiry date (which is usually after 30 days) it will be removed from your account.

This means that you will need to wager your bonus a specified number of times before you can withdraw any of your winnings. Bonus funds are non-withdrawable. Until you have completed the specified wagering requirement, any winnings you make will be held as ‘pending winnings’. If your Bonus reaches its expiry date (which is usually after 30 days) it will be removed from your account.